June 25, 2018

City of Richmond, outlying counties lead region in income growth, VCU study finds

Share this story

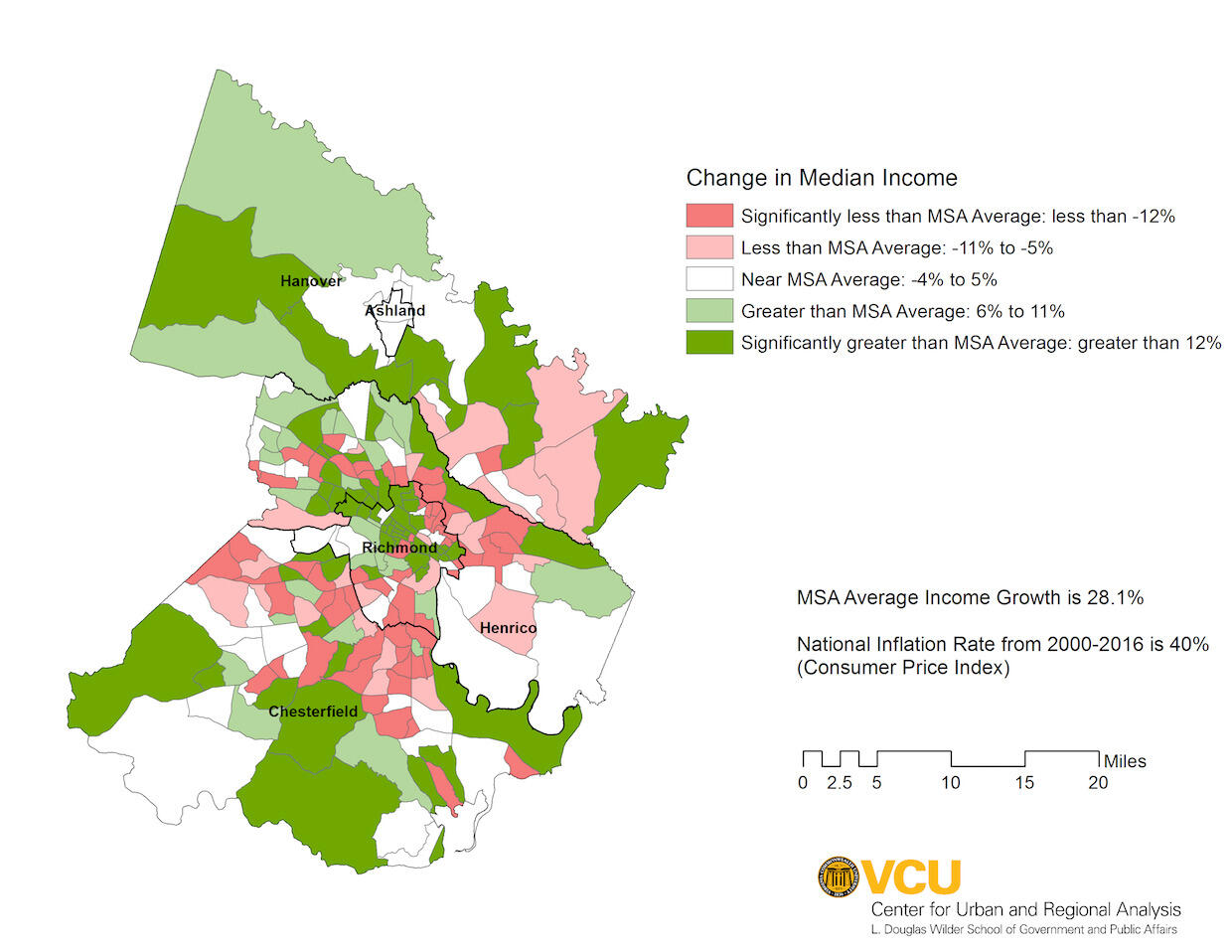

The city of Richmond and the region’s outer counties led the area in the growth of median household income between 2000 and 2016, according to a new report by the L. Douglas Wilder School of Government and Public Affairs at Virginia Commonwealth University.

“A New Income Growth Pattern in the Richmond Metropolitan Area,” prepared by the Wilder School’s Center for Urban and Regional Analysis, shows how traditional patterns of development, both residential and commercial, have changed significantly and pose particular challenges to suburban counties.

“This report confirms a long-term trend of urban improvement and aging suburban decline,” said Tom Jacobson, the center’s lead researcher and an adjunct professor at the Wilder School. “This trend is slow and insidious and requires significant attention from suburban leaders.”

Goochland County showed the biggest percentage increase in median household income during this time, at 46.2 percent, followed by Amelia County (44.8 percent) and Powhatan County (43.9 percent).

From 2000 to 2016, income growth in Richmond increased by 32.3 percent, compared to 29.5 percent and 26.2 percent, respectively, in neighboring Henrico and Chesterfield counties — the region’s traditional suburban centers of economically prospering households.

“National trends of increasing baby boomer and millennial generation interest in urban living are contributing to Richmond’s population and income growth,” the report found. “So, too, are the revitalization efforts of Richmond and [its] experienced nonprofit organizations.”

Richmond neighborhoods of concentrated poverty remain, but household income gain is widespread. Suburban household income lag is prevalent and not concentrated only in the historic low-income neighborhoods. Neighborhoods in Henrico’s West End and Chesterfield’s northern and central areas exhibit weak income growth.

The report covers the localities that form the Richmond Metropolitan Statistical Area. The region had an overall household income gain of 28.1 percent between 2000 and 2016. The northern localities in the region had significantly higher income growth than those in the southern portion.

The Tri-Cities and surrounding area present a different picture.

This area mirrors the historical pattern of urban income stagnation and greater suburban income growth. Colonial Heights and Petersburg trail income growth of the region by 13.3 percent and 16.6 percent, respectively. The adjacent suburban areas of Prince George and southern Chesterfield counties experienced strong income growth.

One factor in the weakness of suburban income growth could be the rise in retired heads of households, the report suggests. The analysis showed no statistical correlation between a rise in percentage of senior household heads and lower income growth at the census tract level.

However, several neighborhoods in the middle-income areas of Chesterfield’s northern and central areas and Henrico’s West End had a significant increase in senior heads of households.

It’s important to understand the income gains in terms of comparative buying power, the report states. Between 2000 and 2016, the U.S. Bureau of Labor Statistics Consumer Price Index — an index of the prices paid for typical consumer goods and services — rose 40 percent, which translates to a decrease in purchasing power.

“That stresses community maintenance and business health, as well as that of households,” Jacobson said.

Subscribe to VCU News

Subscribe to VCU News at newsletter.vcu.edu and receive a selection of stories, videos, photos, news clips and event listings in your inbox.