July 2, 2014

Extra insurance coverage needed for those in disaster-prone areas

Share this story

With the tornado and hurricane seasons well underway, many homeowners in the Midwest and other peril-prone areas are counting on their insurance policies to help them rebuild in the event of a disaster. But even with full coverage, residents in these areas may need extra disaster insurance for catastrophes not covered under their homeowners policies. For instance, if a hurricane causes your home to flood, hurricane insurance will not cover the damage, which is considered flood-related rather than hurricane-related.

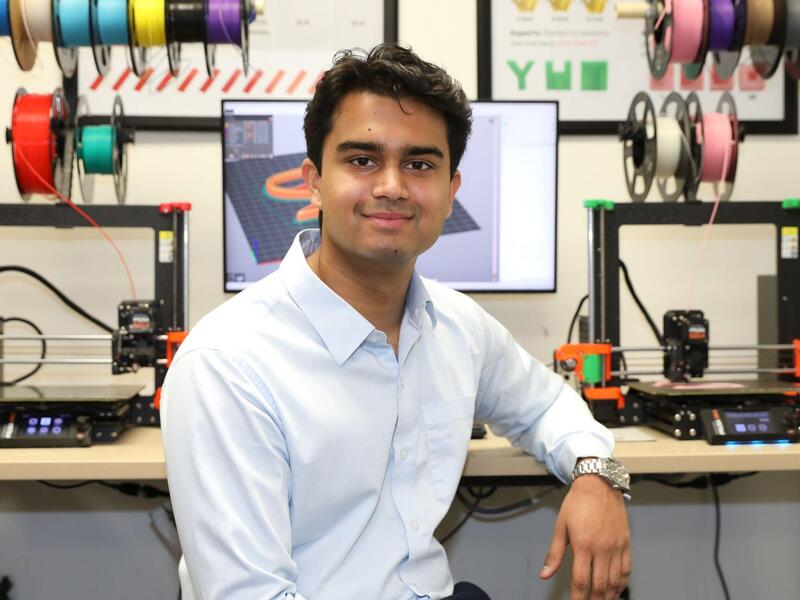

Etti Baranoff, Ph.D., associate professor of risk, insurance and finance in the Virginia Commonwealth University School of Business, cautions that the maximum coverage for flood insurance is $250,000, so homeowners should look into alternative coverage if they’re at risk for inclement weather.

Who needs disaster insurance?

People living in a disaster-prone area because of the perils of areas that can cause a lot of damage. Those [coverages] that are excluded [from typical policies] are earthquakes and any kind of water driven by wind. Flood by hurricane is going to be excluded. So, people that are living in these areas, although they’re not going to have coverage, are going to look for alternatives.

If you’re in California you can probably get it from the Earthquake Disaster Authority. If you’re in Florida where you may have a flood, you can buy it from the flood insurance that belongs to the federal government. People that live in an area that is not prone to disasters will not buy flood insurance from the federal government.

What should homeowners in these areas ask their insurance companies?

Usually, the agents are going to be very careful to give the right coverage. So if the agent looks at the map and sees that you are in a flood-prone area, he’ll tell you that you need to buy additional coverage from federal insurance. The same would be for the inclusion of earthquake insurance.

What mistakes do people make when purchasing disaster insurance? How can they avoid them?

First of all, for the flood insurance, I think the maximum is $250,000. So if you have a $1.5 million home, you have to find some alternative coverage from other kinds of insurance companies if you want more coverage. And these will not be regularly regulated insurance companies.

Let’s say you live in Virginia Beach in your $1.5 million home and you think you may be flooded because the hurricane is going to hit. You have to talk to your agent about how to get the coverage.

Are there any avenues available to homeowners who did not have disaster insurance once a disaster hits?

If the president declares the area a disaster area, there is FEMA money. So they can get very cheap loans to rebuild after FEMA.

What role can insurance play in global efforts to mitigate and adapt to climate change?

A lot of areas in the world do not have insurance coverage. So when there is a loss, it is an economic loss and sometimes the UN agencies may help the people. Right now the global insurance industry really is looking at areas to provide more coverage in a way that is not going to bankrupt the insurance companies.

What would you like to add?

One of the biggest topics right now is that there are a lot people globally that have no insurance whatsoever and even during [Hurricane] Katrina in 2005, most of the losses were not insured losses. They were economic losses. Because if you have a $1.5 million home and you are only taking the coverage and the flood insurance, it will only be up to $250,000. And if it was considered flooded, not wind damaged, wind damage is covered, but a flood is not insured. It’s exempt from insurance. It really is interesting to read the fine print. Not the fine print, even, it’s right there in front of you in the policy.

Subscribe for free to the weekly VCU News email newsletter at http://newsletter.news.vcu.

Subscribe to VCU News

Subscribe to VCU News at newsletter.vcu.edu and receive a selection of stories, videos, photos, news clips and event listings in your inbox.