May 11, 2015

$WAGIFY to offer financial literacy lessons to African-American youth in Richmond

Share this story

A new Virginia Commonwealth University project called $avings and Wealth as Goals in African American Youth — or $WAGIFY — will provide financial literacy lessons to African-American middle schoolers in the Richmond area.

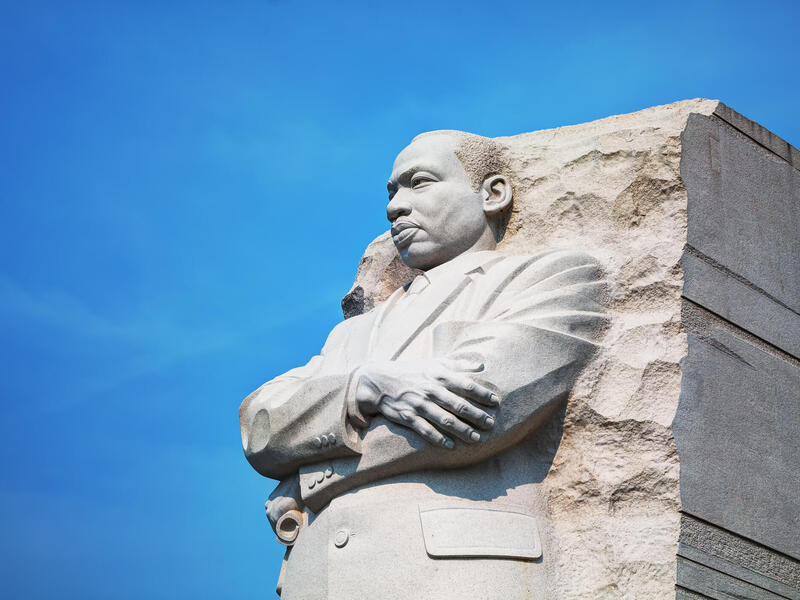

The project aims to develop and pilot a culturally tailored financial literacy program for young African-Americans. The goal, said project leader Vivian Dzokoto, Ph.D., is to help close a persistent knowledge gap among African-Americans when it comes to financial literacy.

"What we've observed is that African-Americans are basically lagging behind the rest of the country, if you look at any national survey, in terms of financial literacy," said Dzokoto, an associate professor in the Department of African American Studies in the College of Humanities and Sciences. "There are lots of indicators. If you look at knowledge of new developments in cryptocurrency, like Bitcoin and so on, African-Americans are the least likely to know about monetary innovations. But even with things like savings and knowledge about investments, African-Americans lag behind."

$WAGIFY, which is a collaboration between an interdisciplinary team of researchers including Dzokoto; Faye Belgrave, Ph.D., a professor in the Department of Psychology; and Kenneth Daniels, Ph.D., a professor of finance in the School of Business; as well as the Richmond nonprofit organizations Camp Diva, which works with African-American girls, and the Ndugu Business Leadership Academy, which works with African-American boys.

The project is funded by a nearly $20,000 Community Engagement Grant, which is awarded by VCU to advance community-engaged scholarship in partnership with Richmond-area organizations to creatively address community-identified needs.

There is a great need for culturally relevant financial literacy lessons for African-Americans, Dzokoto said, because African-Americans lag behind the national average in terms of income and assets.

"The thing about financial literacy is what people know and understand about the financial system shapes how they deal with it," she said. "For example, if people don't know about investing or if people have certain factors that inhibit their ways to save, that sets them up for a life where saving is not deemed important."

She added that even if future generations of African-Americans enjoy greater equalization in income and financial mobility, studies have suggested that it may not actually lead to greater wealth and asset building — highlighting the need for financial literacy.

"Even though aspiring to change society to bring people up to a level where they can earn a living and thrive, you still have to look at the money behaviors because more money does not always mean more savings," Dzokoto said.

This fall, the researchers and VCU students will hold focus groups and test materials to ensure that $WAGIFY will be culturally relevant to young African-Americans. Then, in the spring, the team will launch $WAGIFY as a pilot program with 20 boys and 20 girls from the Richmond area.

The participants will likely attend four to six workshops, which will offer a hands-on, interactive classroom experience. Additionally, the participants' parents will be given a book that addressed parent education of African-American youth in money behavior.

Several of Dzokoto's students provided much of the background research, gathering information on financial literacy within the African-American community. Her interns, for example, called all of the banks in the Richmond area to find out whether any offered culturally tailored financial literacy workshops. They did not find any.

"In general, the notion of cultural tailoring is something that is present in some areas," she said. "In mental health, for example, there is a widely recognized need that paying attention to cultural tailoring is important. But it's not something that is seen as equally important as in other places. And the world of money hasn't been one of those spaces in which the idea of paying attention to culture has been deemed important."

$WAGIFY is one of several programs co-developed or co-sponsored by the Department of African American Studies designed to help young people in Richmond-area schools.

Aashir Nasim, Ph.D., chair of the department, said $WAGIFY is important because it “promises to empower youth with skills to help them effectively negotiate institutional, and in some cases contextual, barriers that may limit their economic and social mobility.”

"$WAGIFY is yet another example of how an interdisciplinary team of scientists — from African-American studies, psychology, and finance — can come together to generate integrity-based solutions to problems that disproportionately impact African-American communities and their youth," he said.

Dzokoto said the team decided to name the project $WAGIFY after much debate.

"We chose $WAGIFY because we want to reinvent the term," she said. "'Swag' is really sort of about conspicuous consumption, which is basically the opposite of conserving money for the future. So we want people to think less about conspicuous consumption and more about saving and investing and building knowledge of financial literacy."

"We did Ke$ha-style it, and added the dollar sign," she added.

Subscribe for free to the weekly VCU News email newsletter at http://newsletter.news.vcu.edu/ and receive a selection of stories, videos, photos, news clips and event listings in your inbox every Thursday. VCU students, faculty and staff automatically receive the newsletter.

Subscribe to VCU News

Subscribe to VCU News at newsletter.vcu.edu and receive a selection of stories, videos, photos, news clips and event listings in your inbox.